FIU stands for Financial Intelligence Unit. It is a specialized agency responsible for collecting, analyzing, and disseminating financial intelligence to combat money laundering, terrorist financing, and other financial crimes.

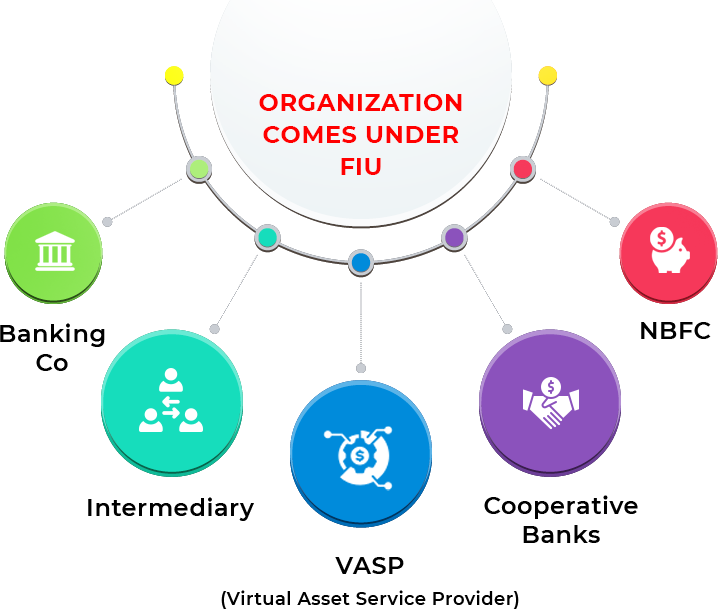

FIUs typically receive reports of suspicious transactions and other financial information from various sources, including financial institutions, designated non-financial businesses and professions (DNFBPs), law enforcement agencies, and other government entities.

FIUs analyze the received information to identify patterns, trends, and anomalies indicative of potential money laundering, terrorist financing, or other illicit activities. This analysis may involve data mining, financial profiling, and other investigative techniques.

FIUs share intelligence and collaborate with domestic and international counterparts, including other FIUs, law enforcement agencies, regulatory bodies, and international organizations, to facilitate the exchange of information and enhance efforts to combat financial crime.

FIUs produce and disseminate reports based on their analysis and findings. These reports may include suspicious transaction reports (STRs), financial intelligence reports (FIRs), and other types of intelligence products to assist law enforcement agencies and other stakeholders in their investigations and preventive measures.

FIUs provide guidance, training, and technical assistance to reporting entities, law enforcement agencies, and other stakeholders to enhance their understanding of money laundering and terrorist financing risks and improve compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

FIUs may contribute to the development of AML/CFT policies, regulations, and guidelines at the national and international levels by providing expertise, research, and recommendations based on their analysis and operational experiences.

FIUs monitor the compliance of reporting entities with AML/CFT obligations, including the submission of suspicious transaction reports and other regulatory requirements. They may conduct examinations, assessments, and audits to ensure adherence to relevant laws and regulations.

Complete the form below and we will contact you to discuss your project. Your information will be kept confidential.